The Apt Differs From the Capm Because the Apt

The APT differs from the CAPM because the APT _____. The APT makes no assumptions about the empirical distribution of asset returns.

The Apt Differs From The Capm Because The Apt A Places More Emphasis On Market Course Hero

B minimizes the importance of diversification.

. Recognizes multiple unsystematic risk factors. B minimizes the importance of diversification. The Arbitrage Pricing Theory APT is much more robust than the capital asset pricing model for several reasons.

C minimizes the importance of diversification. Minimizes the importance of diversification. Places more emphasis on market risk.

The general arbitrage pricing theory APT differs from the single factor CAPM because APT. Option is A III only because under APT multiple economical factors are considered in d View the full answer Transcribed image text. Implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments.

Recognizes multiple unsystematic risk factors D. C recognizes multiple unsystematic risk factors. The Capital Asset Pricing Model CAPM and the Arbitrage Pricing Theory APT help project the expected rate of return relative to risk but they consider different variables.

The feature of the APT that offers the greatest potential advantage over the CAPM is. D recognizes multiple systematic risk factors. Recognizes multiple systematic risk factors E.

None of the above The CAPM assumes that market returns represent systematic risk. The APT differs from the CAPM because the APT _____. Both the capital asset pricing model CAPM and the arbitrage pricing theory APT are methods used to determine the theoretical rate of return on an asset or portfolio but the difference between APT and CAPM lies in the factors used to determine these theoretical rates of return.

None of the above. Recognizes multiple systematic risk factors. An investor takes as large a position as possible when an equilibrium price relationship is violated.

The APT differs from the CAPM because the APT. Question The APT differs from the CAPM because the APT A places more emphasis on market risk. Recognizes multiple systemic risk factors.

Recognizes multiple unsystematic risk factors D. Places more emphasis on market risk. Recognizes multiple systematic risk factors.

There is no special role for the market portfolio in the APT whereas the CAPM requires that the market portfolio be efficient. Another difference is that in APT the performance of the asset is. Recognizes multiple unsystematic risk factors.

The mean-variance efficiency frontier. The APT differs from the CAPM because the APT. The APT differs from the CAPM because the APT.

Places more emphasis on systematic risk The CAPM assumes that market returns represent systematic risk. C recognizes multiple unsystematic risk factors. The APT differs from the CAPM because the APT.

Recognizes multiple systematic risk factors E. Minimizes the importance of diversification C. APT assumes a few large changes are required to bring the market back to equilibrium.

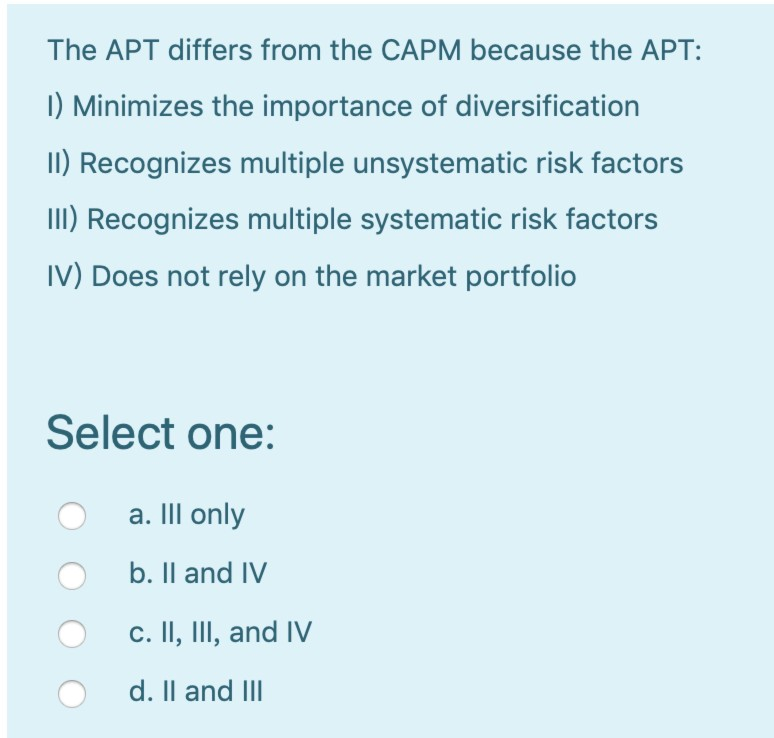

1 Minimizes the importance of diversification I Recognizes multiple unsystematic risk factors I Recognizes multiple systematic risk factors IV Does not rely on the market portfolio Select. APT in essence is a mere extension of CAPM. Places more emphasis on market risk B.

The feature of the APT that offers the greatest potential advantage over the CAPM is the. 36The APT differs from the CAPM because the APT A recognizes multiple systematic risk factors. Minimizes the importance of diversification C.

The CAPM assumes that market returns represent systematic risk. D recognizes multiple systematic risk factors. Recognizes multiple unsystematic risk factors D.

D recognizes multiple systematic risk factors. Applies to well diversified portfolios not individual stocks. While all sources of risk were clubbed together in CAPM APT says that different securities have different sources of risk because of different exposure to the various factors.

Places more emphasis on market risk B. See the answer See the answer done loading. D recognizes multiple unsystematic risk factors.

This is an example of _________. The CAPM assumes that the market returns. The APT differs from the CAPM because the APT _____.

Asked Aug 20 2019 in Business by Meisha. CAPM only looks at the sensitivity of the asset as related to changes in the market. Both CAPM and APT depend on risk-return dominance CAPM assumes many small changes are required to bring the market back to EQ whereas APT assumes a few large changes are required to bring the market back to EQ implications for prices derived from CAPM arguments are stronger than those derived from APT arguments.

APT introduced the concept of factors in asset pricing where factors are quantified macroeconomic shocks. Minimizes the importance of diversification c. B places more emphasis on market risk.

APT depends on a no arbitrage condition. Places more emphasis on market risk b. The APT differs from the CAPM because the APT recognizes multiple systematic risk factors.

CAPM depends on risk-return dominance. Recognizes multiple systematic risk factors e. However the difference lies in the use of a single non company factor and a single measure of relationship between price of asset and the factor in the case of CAPM whereas there are many factors and also different measures of relationships between price of asset and different factors in APT.

Which pricing model provide no guidance concerning the determination of the risk premium on factor portfolios. This is an example of. An investor will take as large a position as possible when an equilibrium price relationship is violated.

The arbitrage pricing theory APT differs from the single-factor capital asset pricing model CAPM because the APT. Minimizes the importance of diversification. CAPM assumes many small changes are required to bring the market back to equilibrium.

A places more emphasis on market risk.

Solved The Apt Differs From The Capm Because The Apt 1 Chegg Com

Capm Vs Apt Introduction By Mercy Mueni Mwangi Medium

Differentiate Between Arbitrage Pricing And Capital Asset Pricing Theory Qs Study

0 Response to "The Apt Differs From the Capm Because the Apt"

Post a Comment